-

What is Research? Definition, Types, Methods and ProcessJuly 25, 2023

-

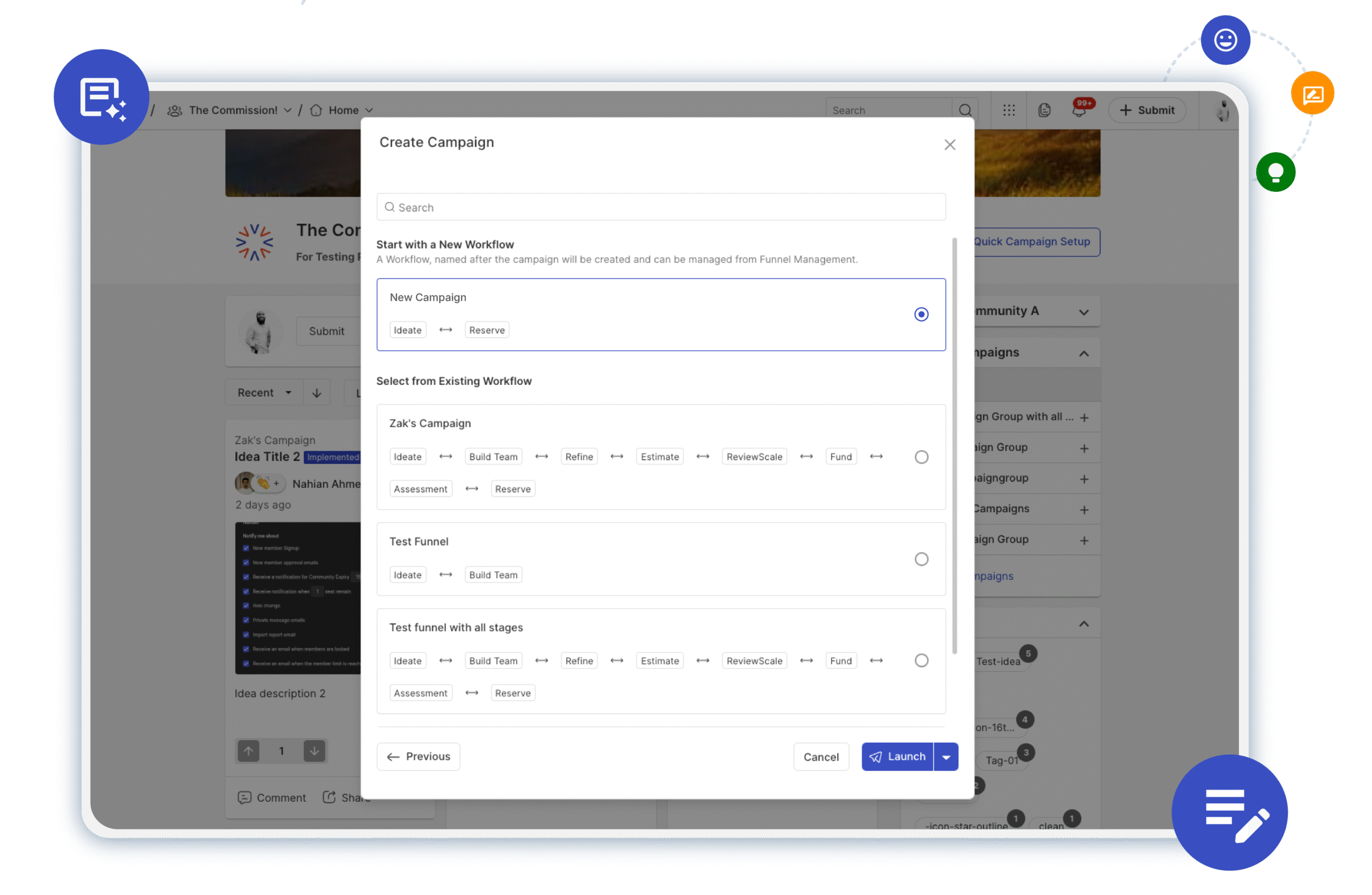

Accelerating Innovation with Campaign and Idea CloningApril 29, 2025

-

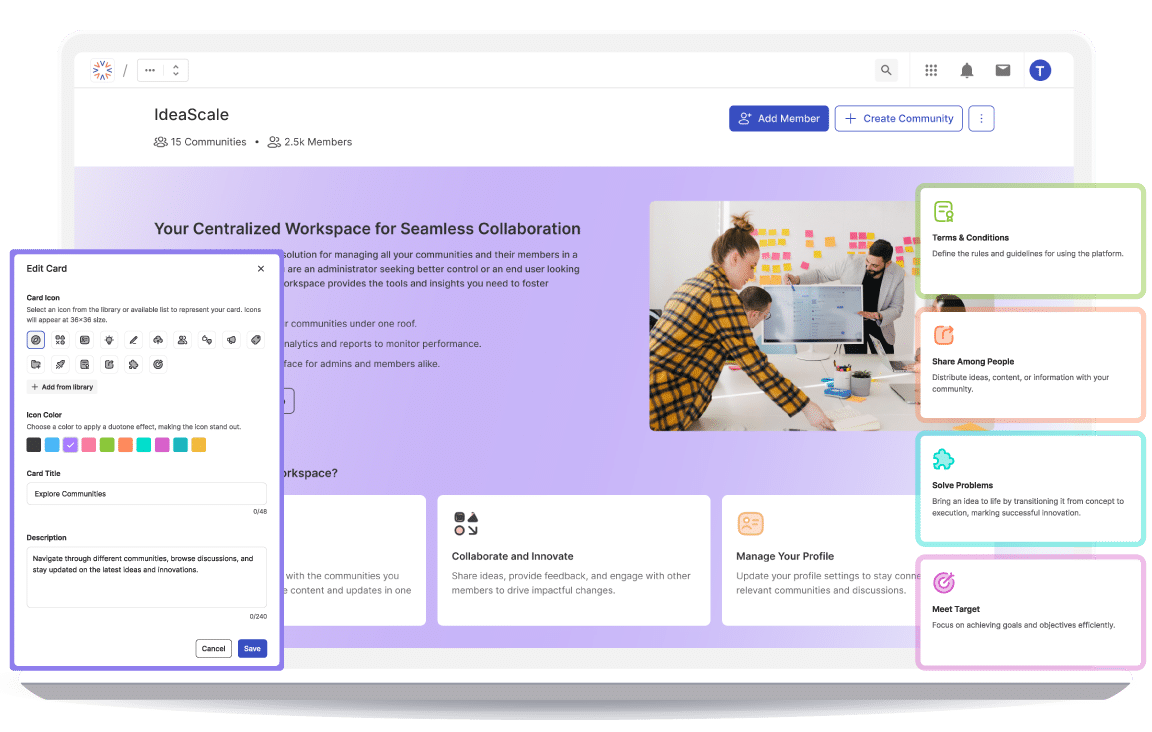

How We Use IdeaScale to Build a Better IdeaScaleApril 22, 2025

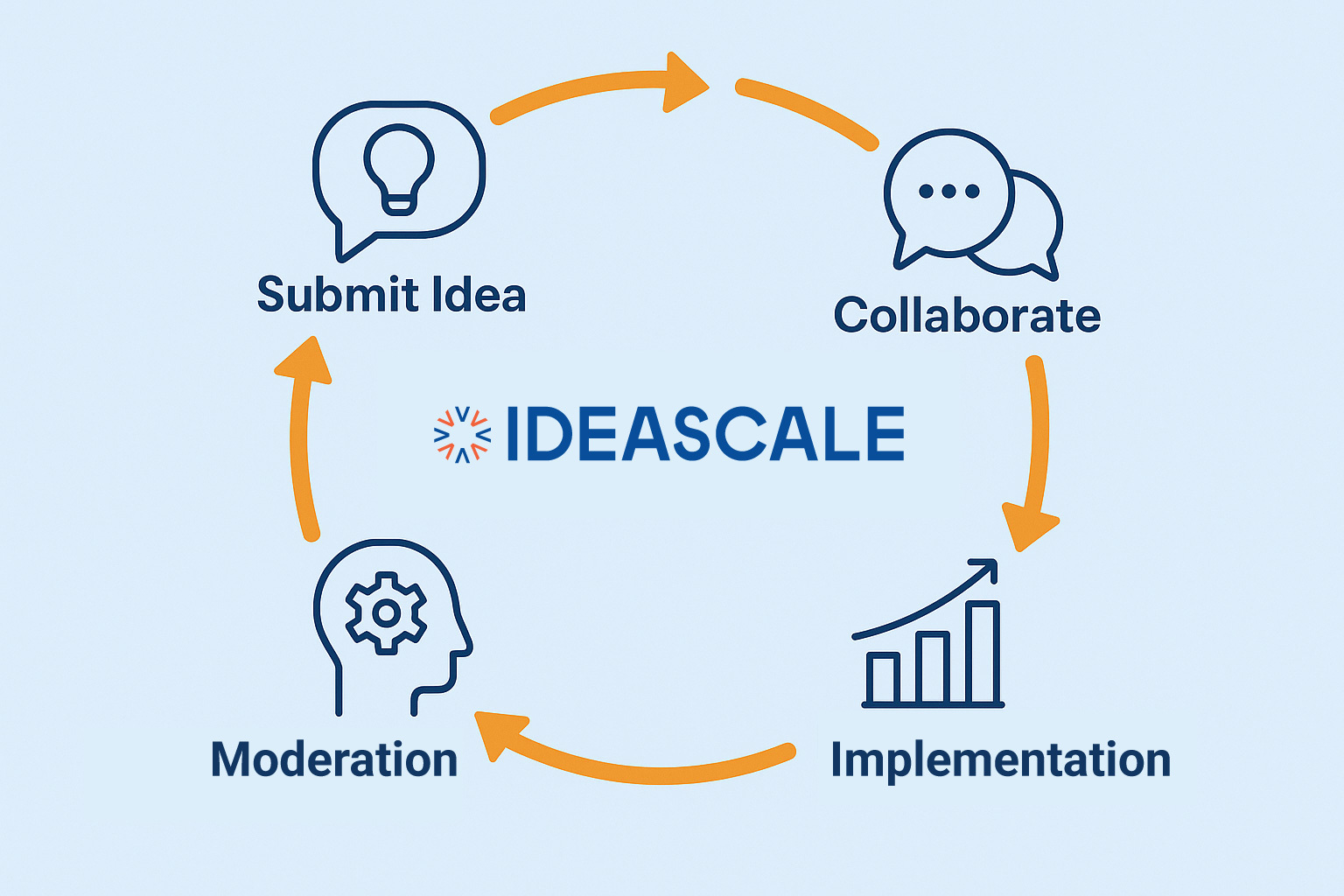

Igniting Innovation

Powerful innovation starts as an idea. Launch your community today!