Table of Contents

In recent years, the finance industry has undergone a profound metamorphosis, catalyzed by the relentless wave of digital transformation. This paradigm shift has not only revolutionized the way financial services are delivered but has also fundamentally altered the landscape in which financial institutions operate. In this blog, we delve into the transformative impact of digitalization on the finance sector, exploring key trends, challenges, and opportunities that lie ahead.

Understanding Digital Transformation in Finance

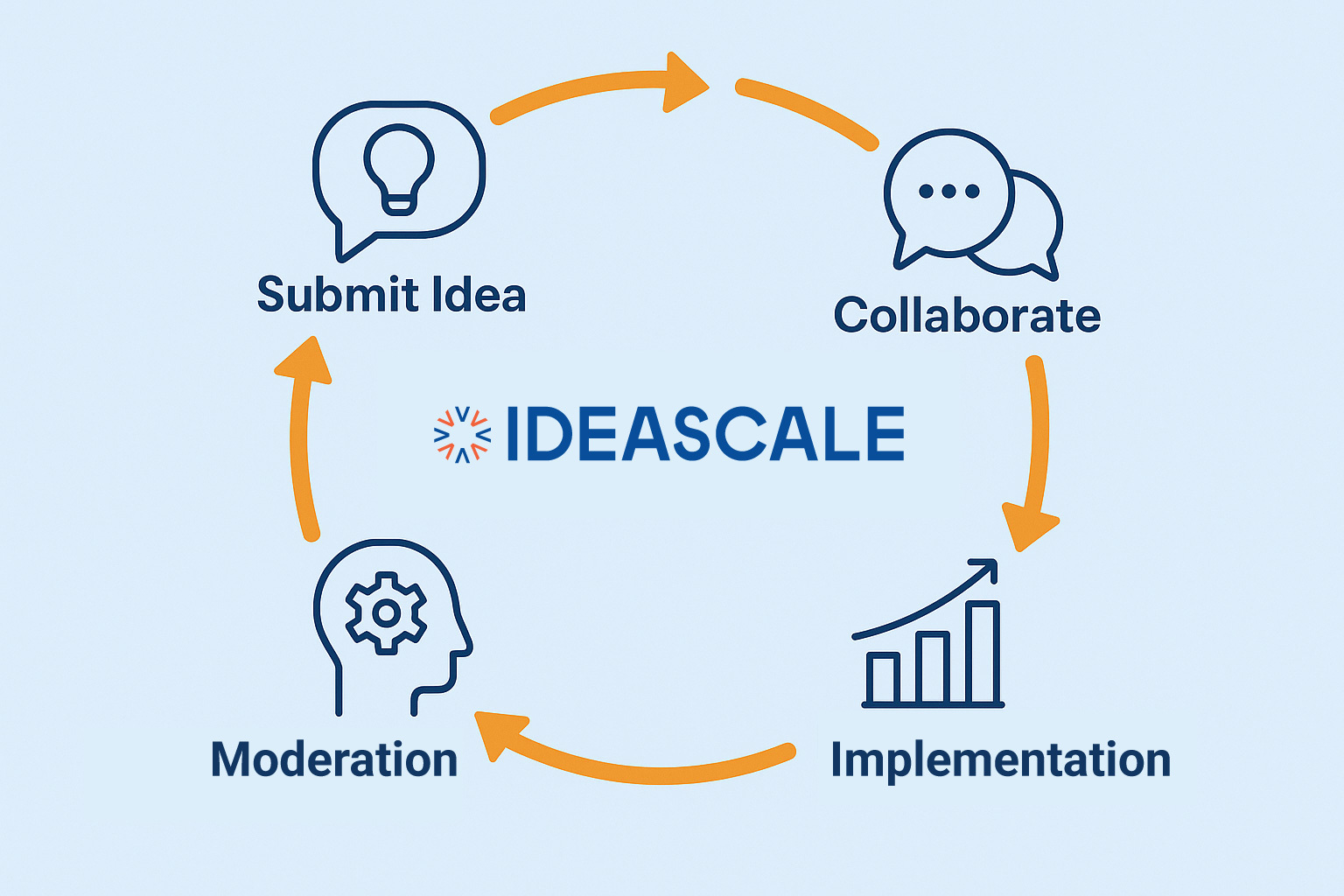

Digital transformation in finance refers to the process of leveraging digital technologies to fundamentally change how financial services are delivered, accessed, and consumed. It involves the adoption of digital solutions, automation of processes, and integration of technology-driven innovations to enhance efficiency, improve customer experiences, and drive business growth within the financial industry. Here are several key aspects of digital transformation in finance:

- Customer Experience Enhancement

Digital transformation aims to provide seamless, personalized, and intuitive experiences for customers across various touchpoints, including web, mobile, and social media channels. From onboarding and account management to payments and support services, financial institutions invest in user-centric design, omnichannel capabilities, and self-service options to meet the evolving needs and preferences of digital-native consumers.

- Process Optimization and Automation

Digital transformation streamlines and automates manual processes, reducing paperwork, eliminating redundant tasks, and improving operational efficiency within financial institutions. Through robotic process automation (RPA), workflow automation, and digital document management, organizations can accelerate decision-making, reduce errors, and free up human resources to focus on high-value activities.

- Data-Driven Decision-Making

Digital transformation leverages data analytics, artificial intelligence, and machine learning to generate actionable insights, inform strategic decision-making, and drive innovation in finance. By analyzing customer behavior, market trends, and operational performance, financial institutions gain a deeper understanding of their customers, identify new business opportunities, and optimize resource allocation to achieve business objectives.

- Risk Management and Compliance

Digital transformation enhances risk management capabilities and regulatory compliance processes through the adoption of regulatory technology (RegTech) solutions. These technologies automate regulatory reporting, monitor compliance with regulatory requirements, and detect fraudulent activities, helping financial institutions mitigate risks, reduce compliance costs, and maintain trust and confidence in the financial system.

- Product and Service Innovation

Digital transformation fosters innovation in financial products and services, introducing new offerings that cater to emerging customer needs and market trends. From digital payments and robo-advisors to blockchain-based solutions and decentralized finance (DeFi) applications, financial institutions embrace technology-driven innovations to differentiate themselves, attract customers, and stay ahead of competitors in a rapidly evolving landscape.

- Partnerships and Ecosystem Collaboration

Digital transformation encourages partnerships and collaboration within the financial ecosystem, enabling financial institutions to leverage the expertise, resources, and technologies of external partners, fintech startups, and technology vendors. By forging strategic alliances, investing in joint ventures, and participating in industry consortia, organizations can accelerate innovation, expand their product offerings, and deliver greater value to customers.

- Cybersecurity and Data Privacy

Digital transformation prioritizes cybersecurity and data privacy measures to protect sensitive customer information, prevent data breaches, and comply with regulatory requirements. Financial institutions invest in robust cybersecurity frameworks, encryption technologies, and identity verification solutions to safeguard digital assets, mitigate cyber threats, and build trust with customers in an increasingly digitized environment.

Overall, digital transformation is reshaping the financial industry, driving innovation, efficiency, and customer-centricity. By embracing digital technologies, financial institutions can adapt to changing market dynamics, meet evolving customer expectations, and unlock new opportunities for growth and competitive advantage in the digital economy.

Key Trends Reshaping the Finance Landscape

- Fintech Disruption: The rise of fintech startups has disrupted traditional banking models, offering agile, technology-driven solutions that resonate with the digital-savvy consumer.

- Data-driven Insights: Harnessing the power of big data and advanced analytics, financial institutions are able to derive actionable insights, enabling personalized services, risk assessment, and fraud detection.

- AI and Automation: Artificial intelligence and automation are driving efficiency gains across various functions within the finance industry, from customer service chatbots to algorithmic trading algorithms.

- Blockchain Revolution: Blockchain technology holds the potential to revolutionize financial transactions, offering enhanced security, transparency, and efficiency in processes such as cross-border payments and smart contracts.

Challenges on the Road to Digital Transformation

While the benefits of digital transformation in finance are undeniable, the journey is not without its challenges. Legacy systems, regulatory hurdles, cybersecurity threats, and cultural resistance pose significant barriers to adoption and implementation. Moreover, the rapid pace of technological advancement necessitates ongoing investment in talent development and infrastructure upgrades to stay ahead of the curve.

Unlocking the Potential: Opportunities Ahead

1. Enhanced Customer Experience: Digital transformation enables financial institutions to deliver seamless, omnichannel experiences tailored to the evolving needs and preferences of customers.

2. Operational Efficiency: By automating manual processes and optimizing workflows, financial institutions can drive operational efficiency, reduce costs, and improve overall productivity.

3. Risk Management: Advanced analytics and machine learning algorithms empower financial institutions to better assess and mitigate risks, enhancing regulatory compliance and safeguarding against fraud.

4. Innovation and Collaboration: Collaboration between traditional financial institutions and fintech startups fosters innovation, driving the development of novel solutions and expanding market opportunities.

The Road Ahead

As the pace of digital transformation accelerates, the finance industry finds itself at a pivotal juncture, poised for unprecedented growth and innovation. Embracing this paradigm shift requires a strategic vision, a culture of innovation, and a commitment to continuous adaptation. By harnessing the power of technology and embracing a customer-centric approach, financial institutions can navigate the complexities of the digital age and emerge as leaders in the rapidly evolving landscape of finance.

Digital transformation represents a paradigm shift that is reshaping the finance industry in profound and unprecedented ways. By embracing innovation, harnessing the power of technology, and fostering a culture of agility and adaptation, financial institutions can unlock new opportunities, drive sustainable growth, and deliver unparalleled value to customers in the digital age.

Learn more: What is Fintech Innovation?

Most Recent Posts

Explore the latest innovation insights and trends with our recent blog posts.