What is the Ansoff Matrix?

The Ansoff Matrix is defined as a pivotal tool in enterprise growth planning that strategically identifies pathways for expansion. This 2 by 2 matrix evaluates existing and new products against existing and new markets, yielding four growth strategies: market penetration, market development, and product development/diversification. Companies leverage the Ansoff Matrix to make data-driven decisions, mitigating risks while capitalizing on growth opportunities. This comprehensive guide explores the practical application of the Ansoff Matrix through real-world examples and case studies, making it an indispensable resource for businesses aiming to navigate strategic growth effectively.

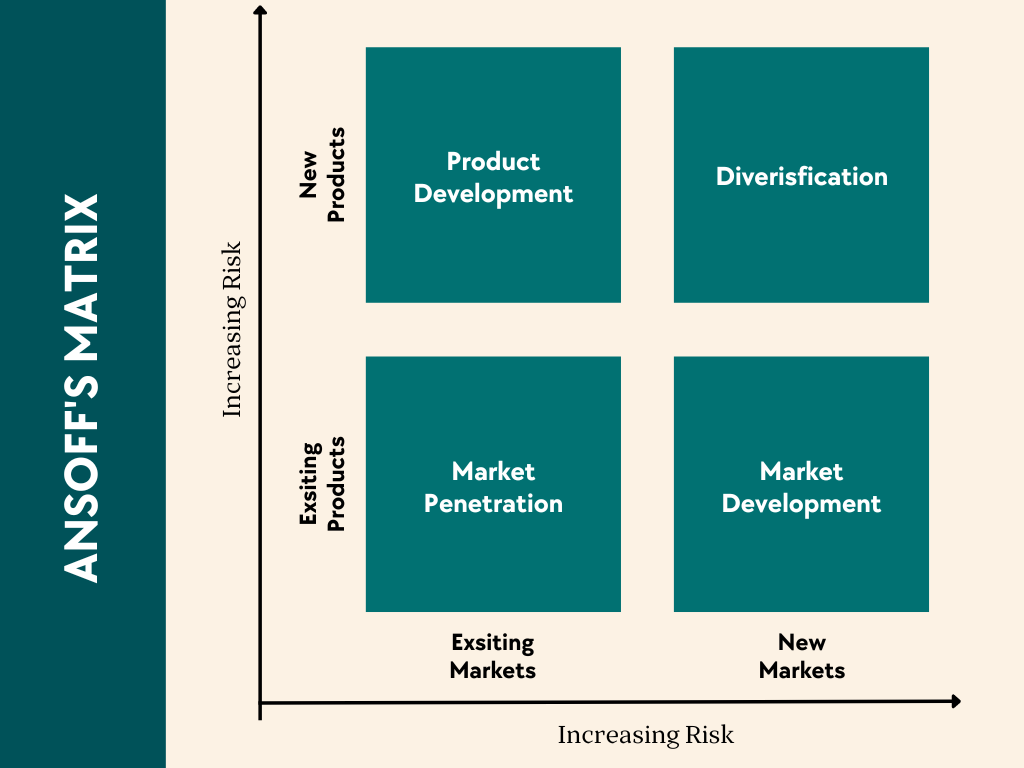

Here is the layout of the Ansoff Matrix:

- Existing products: The existing products or services portfolio of the enterprise.

- New products: These are new products that the company plans to launch in existing and/or new markets.

- Existing markets: The existing markets where the existing products/ services are being targeted.

- New markets: The markets in which the company aspires to sell existing or new products.

On the X-axis lies products, that is, existing products and new products. On the Y-axis lies existing markets and new markets. The graphical layout of this growth matrix is such that the further away from point zero, the more increased risk the business will encounter. This is because the further away we move along the X or Y axis, the newer the products and markets.

The 4 Growth Strategies of Ansoff Matrix

Navigating growth requires a strategic approach, and the Ansoff Matrix stands as a beacon for enterprises seeking expansion. Let's delve into the actionable strategies offered by this influential tool, designed to propel businesses toward new horizons.

1. Market Penetration: Maximizing Existing Markets

The first quadrant of the Ansoff Matrix is dedicated to market penetration, where businesses concentrate on maximizing their presence in existing markets. This strategy involves increasing market share, often through tactics like aggressive marketing, promotional campaigns, or enhancing product/service offerings. Discover how market penetration can solidify your foothold and elevate your brand's visibility.

2. Market Development: Expanding into New Territories

Venturing beyond familiar territories, market development takes center stage in the second quadrant. This strategy entails introducing existing products or services to new markets, either geographically or demographically. Explore the nuances of market development and learn how businesses unlock fresh opportunities by tapping into uncharted territories.

3. Product Development: Innovating for Existing Markets

Innovation takes precedence in the third quadrant, where product development becomes the driving force. This strategy involves introducing new products or services to existing markets, catering to evolving customer needs and preferences. Uncover the strategies behind successful product development initiatives and how they contribute to sustained growth.

4. Diversification: Pioneering New Markets and Products

The fourth quadrant, diversification, represents the pinnacle of strategic expansion. This involves introducing new products or services to entirely new markets, diversifying the business portfolio. Delve into the realm of diversification strategies, understanding how businesses mitigate risks and capitalize on untapped markets.

Exploring Success Stories and Case Studies

Embark on a journey through real-world success stories and case studies that exemplify the effective implementation of Ansoff Matrix strategies. Gain insights into how renowned companies have navigated their growth trajectories, providing practical lessons for your own strategic endeavors.

Maximizing Your Business Potential with Ansoff Matrix Strategies

Concluding our exploration of Ansoff Matrix strategies, we'll discuss actionable steps for businesses to implement these strategies successfully. From strategic planning to execution, discover the keys to unlocking your business's full potential and achieving sustainable growth.

Learn more: What is the RACI Matrix?

Examples of Ansoff Matrix

Here are 3 examples that will walk you through the application of Ansoff Matrix across the three most dominant types of products today, Software-as-a-service (SaaS), consumer goods, and capital goods:

Example 1. Software-as-a-service (SaaS) company growth strategy

- Market penetration: A B2B software company, aiming to sell more of the same product in the same market- would typically involve online marketing, email marketing, and to some extent, some cold calling. Software is best marketed online given the nature of the product.

- Market development: When a SaaS product is being launched in a new market, the company will still need to take the route of market research to understand product demand. Market development for online products is easier since service and sales can be done remotely.

Since new products often require specialized marketing and sales pitches, the enterprise may decide to have separate teams to market different product lines, often under the same leadership. This is particularly the case if the new market has a different language.

- Product development: In this strategic approach, adding new products involves product and market research studies, followed by either in-house product development or purchasing another company that caters to the same market.

Since the new product will be sold in the same market, the company's existing marketing team can simply add the new products to their portfolio to be marketed. In case of a company buy-out, the new product company's marketing team may also be leveraged.

- Diversification: Although this is the riskiest strategy, it is certainly less risky for a SaaS or internet-based B2B company, where it takes considerably less investment to launch a new product in a new market. The research and marketing efforts can be done remotely and the product itself is virtual and available immediately for download and play.

The risk is even lower if the new market has the same language as the native one, which saves time in translation and translation-related issues. If the new market shares similar cultures then the marketing team may even be able to reuse some of the material being used in the native market.

Example 2. Consumer goods company growth strategy

- Market penetration: For a consumer goods company, deeper penetration means making the same products/ services physically available in more areas in the same market. Unlike a SaaS company, this means investment not just in marketing and sales, but also in production and physical distribution of the products. This can be achieved either through in-house production upgrades, logistics, warehouse and outlet expansion through a franchise model or through 3rd party vendors in either or all aspects of expansion.

- Market development: Market development for a consumer goods company once again includes expansion of operations into the new market using the same product line. The firm needs to first conduct market research among consumers and product feasibility tests. Then comes the actual work of producing the new product, managing logistics to make the new product available in the new market, setting up post-sales services, and perhaps even office space for new employees if the geographic location is different and demands it.

- Product development: New product development for consumer goods is a complex process involving the physical sourcing of raw materials, workers, factory productions, marketing, and sales. However, since the market is the same, less time will be required for product feasibility tests.

- Diversification: A new consumer goods product in a new market is indeed risky. Not only will the enterprise need to thoroughly research the new market for the new product, but it will also have to deal with new material suppliers, human resource specialization in the new product, possibly new factories, and expansion to new geographic regions. This requires significant investment and the stakes are often high. The enterprise's management team therefore needs to conduct market research, cost-benefit, fit into overall enterprise strategy, etc. to ensure that the new product succeeds in the new market – if the launch is worth the risk.

Example 3. Capital goods company growth strategy

- Market penetration: Capital goods companies sell primarily to other businesses. Being B2B and in the same market with the same products requires less market research investment, as would be needed when sampling and surveying a large number of consumers. Furthermore, it makes it easier to expand through business referrals. Additional marketing and advertising strategy remains the same, but more aggressively targets the existing market with the same product line.

- Market development: Expanding markets with the same product possesses similar challenges and opportunities as in the case of consumer goods. Considerable research needs to be conducted in the new market, followed by how the company wants to make the products available. This may involve simply logistics operations or opening new factories for production. Often companies when expanding to new markets choose not to increase investment risk by opening new production facilities, instead choosing to first test the product demand for a few years before making a large investment in production.

- Product development: Unlike a SaaS company where a new product simply means new software to be coded often by the existing team, new product development for capital goods involves new production lines. To facilitate this, the enterprise may choose to add capabilities to existing production locations or open new dedicated production facilities to manufacture the new product if there is no compatibility in the production process with existing products.

Market research requires the least investment here if the product is related to the products already in production since it is to be sold in the same market. For example, an automobile ancillary manufacturing plant may already be producing steel ball bearings and now may be expanding to steel rivets. Much of the melting process of the steel will be the same, with a change in the molding process. The buyers may also be the same (automobile manufacturers) and require little investment in researching the scope of business as the enterprise sales leaders are already in touch with buyers of similar products used in the manufacturing of the final product, which is the automobile. A company can also cut through much competition in the new product space by selling to existing clients.

- Diversification: To successfully launch a new B2B goods product in a new market, the enterprise needs to invest considerably in primary and/or secondary market research to fully understand the scope of penetration and competitiveness.

Before launching the product, if the new market is a new geographic location, the company may need to figure out logistics involving supplying to the new market, with HR considerations to set up service, marketing, and sales teams for the region. New languages add to the complexity of selling a new product. Businesses may try to leverage existing business contacts or referrals for the initial breakthrough needed before marketing results kick in.

If the product is related, it is easier to manage human resources since existing staff may take up additional work till the business can hire more employees. Furthermore, factory productions may be from the same unit if the related new product has manufacturing compatibility.

A completely new product in this space would most likely require a new production factory with more acute HR needs to fill critical positions to begin production and supply.

Learn more: What is Eisenhower Matrix?

Benefits of Applying Ansoff Matrix

- Provides a framework for enterprise growth

Enterprise growth is not an accident, it is a matter of planning out areas of expansion and focusing on realistically achievable goals. Ansoff Matrix is a key tool in the hands of any company's management struggling with growth plans. Even if a company has planned out a growth path, this tool is still a beneficial method to reevaluate and ensure the best growth strategy is chosen. This is after all the underlying theme that will drive the enterprise's future.

- Helps optimize risk-taking and risk management

The 4 strategies of Ansoff Matrix move from simple and least risky to complex and most risky, allowing the management team to pick the strategy that best suits their risk appetite. This may be the most important attribute of this method of plotting enterprise growth.

- Leverages existing company strengths

The Ansoff Matrix's 4 strategies are not just an effective risk management tool but also help ensure that existing business strengths are leveraged. This, of course, is at its peak during the 'market penetration' approach, while decreasing steadily as we approach 'diversification'.

Top 4 Best Practices While Applying Ansoff Matrix in 2023

1. Use one matrix per product

In the case of multiple products, each may cater to a different market segment. For example, a survey software company may have two different products for customer feedback and employee feedback.

In such situations, the user of the matrix needs to ensure that only one matrix is used per product to avoid errors in judgment arising out of wrongly bundling products during analysis.

2. Know your risk appetite

Ansoff Matrix uniquely combined growth strategy with risk management. Each strategy is riskier than the previous with rising growth potential in case of success. To pick the right strategy that will lead to enterprise growth, the leaders need to be well-calculated in risk appetite. This includes financial and accounting details and is key to ensuring success in growth. A riskier strategy than what the enterprise wallet can bear could lead to venture failures or worse, bankruptcy.

3. Ensure accurate price projections

Drawing more from the previous point, the leadership team needs to ensure that the right pricing metrics are being used when projecting a strategy's cost. Cost overruns are often a result of poor price projections while planning and could disrupt the strategy.

4. Involve the right stakeholders

The planning process involving the 4 strategies of the Ansoff Matrix requires business leaders to consult and involve the right stakeholders who will be involved in the operations regardless of which strategy is finally picked. These are people who are most accurately aware of ground realities. Furthermore, when the strategy is sealed, it is these team leaders and managers who will be leading the plan.

Learn more: RACI Matrix Vs ARPA Model

Most Recent Posts

Explore the latest innovation insights and trends with our recent blog posts.