The financial services sector isn’t known for people-first approaches. Even with the gloss of “fintech” entrepreneurs, once you get past the flashy apps, the customer is often just another product in the end. Lake Trust Credit Union, which aims to serve some of the most financially disadvantaged communities in America, has decided to buck that trend and use human-centered design instead.

Doing Good In The Neighborhood

Blake Woods, Innovation Catalyst for Lake Trust Credit Union, explained in a recent Ideascale Nation podcast:

“I live and work in metro Detroit, and we have the largest un- and underbanked population in the US and Canada. Nearly one out of four residents here are disconnected from the banking system.”

Transactions are done with money orders, check-cashing storefronts, and other expensive last-resort institutions, placing a further burden on the community Lake Trust serves.

These problems weren’t abstracts, as Lake Trust’s own team struggled with them. “We start with our own employee base. We have employees living paycheck to paycheck. It’s our loved ones, our friends and family, that are suffering in this way,” said Woods.

The structure of credit unions is human-centered by design, as they’re non-profits owned entirely by their depositors. It’s a question of finding the ideas that support that mission.

Credit unions are about human-first financial savings.

Teamwork For The Community

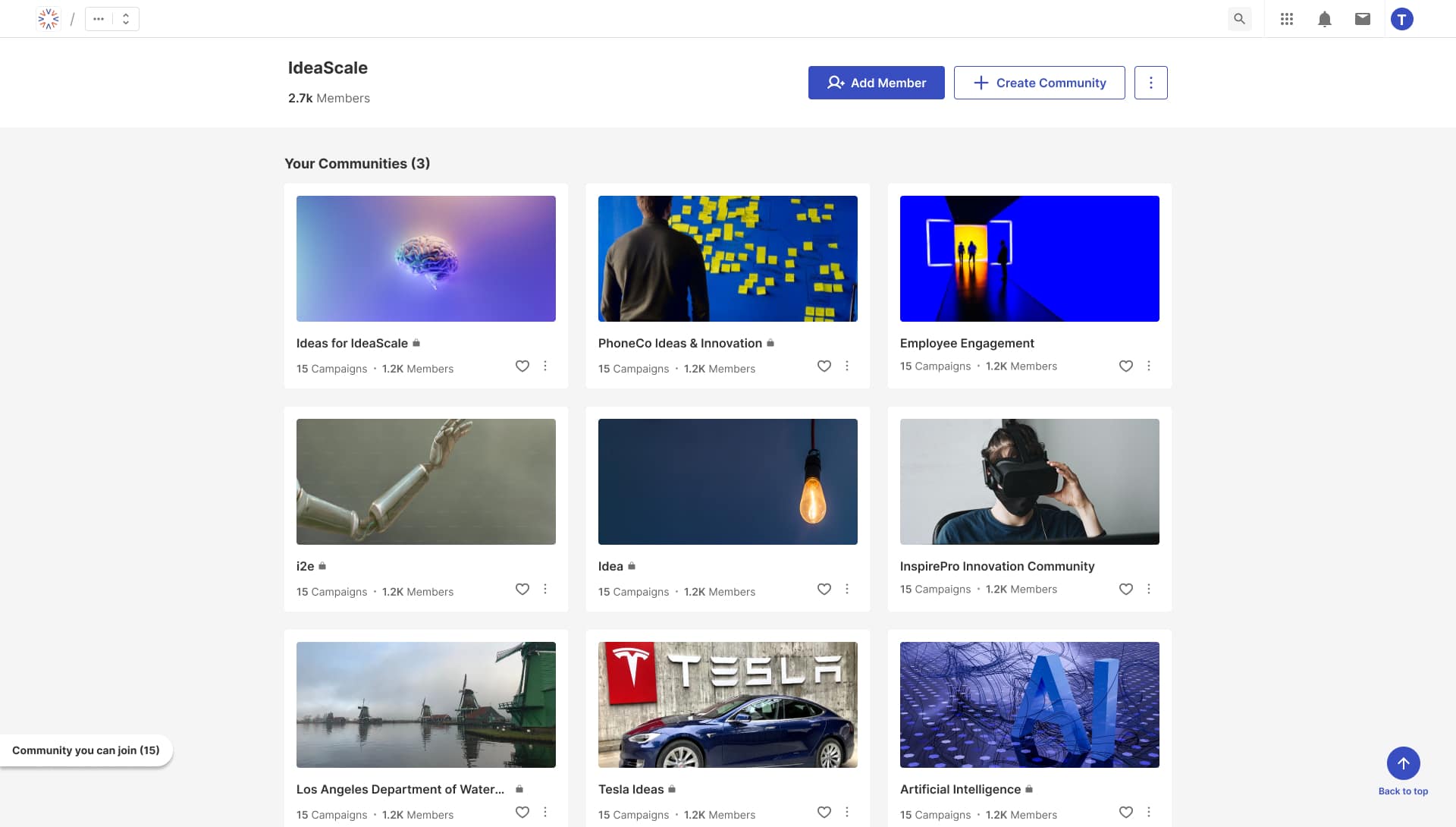

At Lake Trust, innovation starts with an online community called Gather, where people can work on approaches to challenges. Put the problem statement out there, and any employee can submit ideas, put together a team, and submit it to subject matter experts for refinement. In fact, employees are encouraged, from their first day, to join Gather and participate in teams or start their own. Employees have even launched book clubs and talent shows using the platform.

Winners get a trophy, but the real reward is getting the idea put into action. One of the ideas was the Aspire CD. A large majority of members weren’t saving, and younger members were living paycheck-to-paycheck. The goal was to make stale products like CDs and money market accounts look fresh.

“A person from the accounting department came up with the idea that the customer told us the goal, and once they hit the goal, they could take the money out penalty-free”, Woods explained, instead of waiting for the term on the instrument to end. Members saved for car down payments, vacations, homes, and more, turning a tired instrument into a tool for achieving a financial end. Woods noted:

“Financial services can be really dull, but when you connect it to people’s purposes or desires, that’s where this work becomes really rewarding.”

Not every idea, great or not, gets through. “We had a lot of regulation come down around lending from the government and had a new loan origination system come in. And we won a federal grant that enabled us to do some small-dollar loans to businesses in our area,” Woods said.

Last Words

Lake Trust got quite a few great lending ideas, and the struggle was setting a balance between expectations and resources. In the end, the credit union had to pick and choose among a bouquet of excellent approaches. “We just don’t have the resources to work on everything,” Woods admitted. Lake Trust will keep making the effort, though, as more and better ideas build a stronger community.

Most Recent Posts

Explore the latest innovation insights and trends with our recent blog posts.